Be Prepared: Wages, the W-2, and 1098-E Forms

/DISCLAIMER: These articles are based on the tax requirements for 2020. Tax requirements change frequently, so future requirements may be different. This article and future articles on this subject are not tax advice, they are meant to help you to know what documentation to prepare when submitting your information to your tax preparer. Always check with your tax preparer for the proper documentation required for that year, and for any specific tax advice.

Be Prepared (Part 4):

Wages, the W-2, and 1098 Forms

As the title suggests, being prepared to do your taxes is important as it can save you time. It can also save you money. The organized documentation you give to your tax preparer, even if it you do your own taxes will make the work go faster and it will enable the correct calculation of your tax or refund. No sense paying too much or getting a smaller refund than you deserve.

Key Terms that will be used in this and other articles:

Wages

Income earned from an employer, which can vary depending on performance of labor.Salary

A fixed, predetermined level of income agreed upon by employer and employee.Form W-2/Wage & Tax Statement

The form containing annual wages and taxes withheld.Income

The wages, interest, dividends, and other sources of money you receive during the year.Taxable income

The income that is left after all deductions, which are taxed at the appropriate tax rate.

Wages

After Dependents on the 1040 Form, the first line listed as #1 is Wages. Wages are reported to the IRS and the state on the W-2 form.

Form W-2: the Wage and Tax Statement

Form W-2, also known as the Wage and Tax Statement, is the document an employer is required to send to each employee, the state, and the IRS at the end of the year. A W-2 reports employees' annual wages and the amount of taxes withheld from their paychecks. A W-2 employee is someone whose employer deducts taxes from their paychecks and submits this information to the government.

Who Files Form W-2?

Tax documents are filed for the previous year. For example, if you received a W-2 form in January 2021, it will have reflected your income earned for 2020. An employer is legally required to send out a W-2 form to every employee to whom they paid a salary, wage, or another form of compensation. This does not include contracted or self-employed workers, who file taxes with different forms, such as a 1099 form. The employer must send the employee the W-2 form on or before January 31st each year, so that the employee has ample time to file income taxes before the deadline (which is April 15 in most years).

Employers must also use W-2 forms to report to the Federal Insurance Contributions Administration (FICA) taxes for their employees throughout the year. FICA taxes go toward your Social Security benefits when you retire. Employers must file Form W-2, along with Form W-3, for each employee with FICA withholdings for the previous year, by the end of January.

Tax Form W-3 is a transmittal, from which total earnings, Medicare wages, Social Security wages, and withholding for all employees encompassing the entire year are forwarded to the Social Security Administration. The SSA uses the information on these forms to calculate the Social Security benefits to which each worker is entitled.

How to Report Data from Form W-2

If you are an employee of a company and will receive a W-2 for your income taxes, it will be sent to you automatically each year by your employer. Your employer will also submit a copy of your W-2 to the IRS.

The information that you provided on Form W-4 (or sometimes Form W-9) when you are first hired provides the information your company needs to keep track of payroll, tax withholding, employer-provided benefits, and pre-tax contributions to things like a 401(k) retirement plan. The W-4 form tells the employer the amount of tax to withhold from an employee's paycheck based on the person's marital status, number of allowances and dependents, and other factors.

When you prepare your income taxes, you will need to input the data found on your W-2 into the 1040, individual tax return, either by hand or electronically. Online tax preparation software now allows you to directly import the information on your W-2 from your payroll provider in many cases.

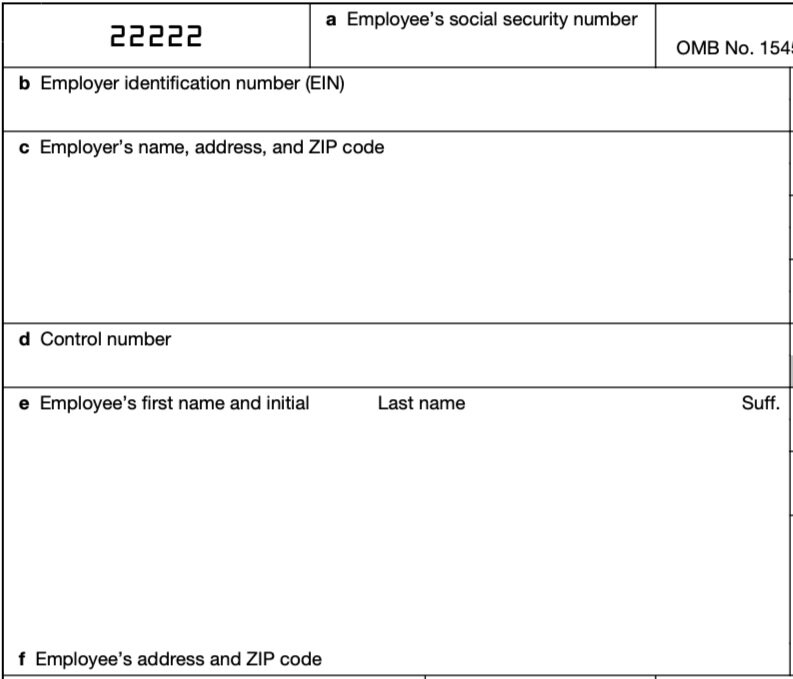

What Information is on Form W-2?

Every W-2 has the same fields, no matter the employer. W-2 forms are divided into state and federal sections since employees must file taxes on both levels. Some fields provide the employer's information, including the company's Employer Identification Number (EIN) (federal) and the employer's state ID number. The remaining fields are mostly details of the employee's income from the previous year.

The employee's total annual earnings from the employer are recorded, along with the amount withheld in taxes from the employee's paychecks, which are separated into the withholding for federal income tax, Social Security tax, and more. If the employee also works for tips, a field shows how much money in tips the employee earned for the year. If you work multiple jobs that provide W-2s, you need to input the data from each onto the 1040 form separately. When you, as an employee, file taxes, the amount of tax withheld according to the W-2 form is deducted from your gross tax obligation. If more tax was withheld than you owe, a refund will be issued.

The IRS also uses Form W-2 to track an employee’s income and tax liability. If the income reported on your taxes doesn’t match the income reported on the Form W-2, the IRS may audit you, the taxpayer. However, taxpayers are required to report all salary, wage, and tip income, even if that income is not reported on a W-2.

How to Read Form W-2: Wage and Tax Statement

W-2 forms include both numbered and lettered boxes that an employer must fill out and reflects how much you earned, and taxes withheld:

Boxes A through F

The lettered boxes on a W-2 include the name and address of you and your employer, your Social Security number, and your employer's EIN and state ID numbers.

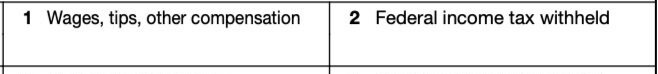

Boxes 1 and 2

Box 1 shows your taxable income, including wages, salary, tips, and bonuses; Box 2 shows how much federal income tax your employer withheld from your pay.

Boxes 3 and 4

Box 3 details how much of your earnings were subject to Social Security tax; Box 4 shows the amount of Social Security tax that was withheld.

Boxes 5 and 6

Box 5 spells out how much of your pay is subject to Medicare tax; Box 6 how much was withheld. The employee portion of the Medicare tax is 1.45%.

Boxes 7 and 8

If part of your pay is in the form of tips, these boxes show how much you reported in tips (Box 7) and how much your employer reported in tips it paid to you (Box 8).

Box 9

This box was used to reflect a now-defunct tax perk (as of 2020), so it is left empty.

Box 10

Box 10 reports how much you received from your employer in dependent care benefits (if applicable).

Box 11

This box details how much deferred compensation you received from the employer. Deferred compensation is a portion of an employee's compensation that is set aside to be paid later. In most cases, taxes on this income are deferred until it is paid out. Forms of deferred compensation include retirement plans, pension plans, and stock-option plans.

Box 12

Box 12 details other types of compensation or reductions from your taxable income and a single- or double-letter code that corresponds to each. It might include, for example, contributions to a 401K retirement plan. Codes are detailed in the IRS' W-2 instructions.

Box 13

This box has three sub boxes designed to report pay that is not subject to federal income tax withholding. This applies if you participated in an employer sponsored retirement plan, or if you received sick pay via a third-party, such as an insurance policy.

Box 14

This box allows an employer to report any other additional tax information that may not fit into the other sections of a W-2 form. A few examples are state disability insurance taxes withheld, and union dues. FMLA, maternity/paternity leave, and short- or long-term disability claims are included in Box 14.

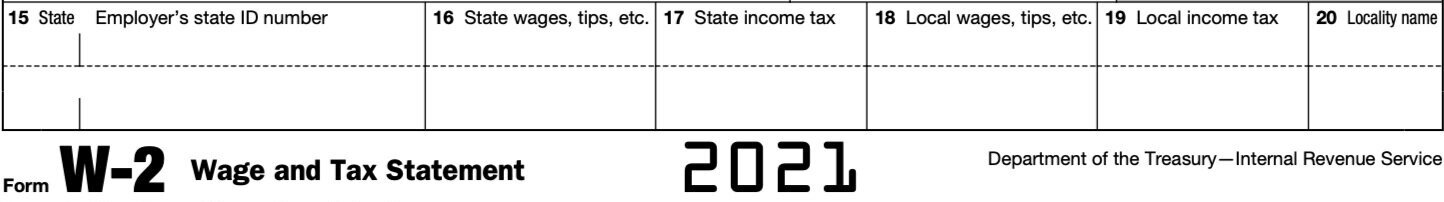

Boxes 15-20

The last six boxes on a W-2 all relate to state and local taxes, including how much of your pay is subject to these taxes, and how much was withheld.

Form 1098-E: College-Related Payments

Students receive a 1098-E statement for any year in which they paid interest on a federal student loan. Students also receive a 1098-T statement reporting college tuition expenses that might entitle students to tax deductions or credits.

Stay tuned for Part 5 of our “Be Prepared” series on tax preparation.

Share your comments at the bottom of the page.

© Whatismyhealth

Special thanks to our resources:

https://www.irs.gov/forms-pubs/about-form-w-2

https://www.irs.gov/forms-pubs/about-form-1099-misc

https://www.irs.gov/forms-pubs/about-form-w-4

https://www.irs.gov/forms-pubs/about-form-w-9

https://www.investopedia.com/terms/w/w4form.asp

A checklist of common documents related to deductions and credits that you will need when preparing to file your taxes for last year.