Be Prepared: The 1040 Form & Filing Status

/DISCLAIMER: These articles are based on the tax requirements for 2020. Tax requirements change frequently, so future requirements may be different. This article and future articles on this subject are not tax advice, they are meant to help you to know what documentation to prepare when submitting your information to your tax preparer. Always check with your tax preparer for the proper documentation required for that year, and for any specific tax advice.

Be Prepared (Part 1):

The 1040 Form & Filing Status

As the title suggests, being prepared to do your taxes is important, as it can save you time. It can also save you money. The organized documentation you give to your tax preparer, even if you do your own taxes will make the work go faster and it will enable the correct calculation of your tax or refund. No sense paying too much, or getting a smaller refund than you deserve.

Key Terms that will be used in this, and other articles in this series:

Filing status

One of five different methods of how the IRS has categorized individual tax situations. This post will cover more about the filing statuses below.

Income

The wages, interest, dividends, and other sources of money you receive during the year.

Deductions

Think of deductions like expenses. Deductions are removed from your income, and then the appropriate tax rate is applied to the difference between your income and your deductions.

Standard Deduction

Each filing status is given a predetermined deduction called the standard deduction. Any deductions over the standard amount can be used to further reduce your taxable income. If you the taxpayer do not have more deductions than the standard amount, then the standard is used by default.

Taxable income

The income that is left after all deductions, which are taxed at the appropriate tax rate.

Tax Rate

The tax rate is the percentage that is applied to your taxable income. The tax rate depends on your filing status and your taxable income. There are seven tax rates, ranging from 10% to 37%. You can find current tax rate examples under each of the filing statuses below.

Itemized Deductions*

Itemized deductions are expenses that get listed on the Schedule A form. These include medical expenses and property taxes, state taxes, donations (referred to by the IRS as contributions) of money, clothes, furniture, or other assets to non-profit organizations, among other smaller level items.

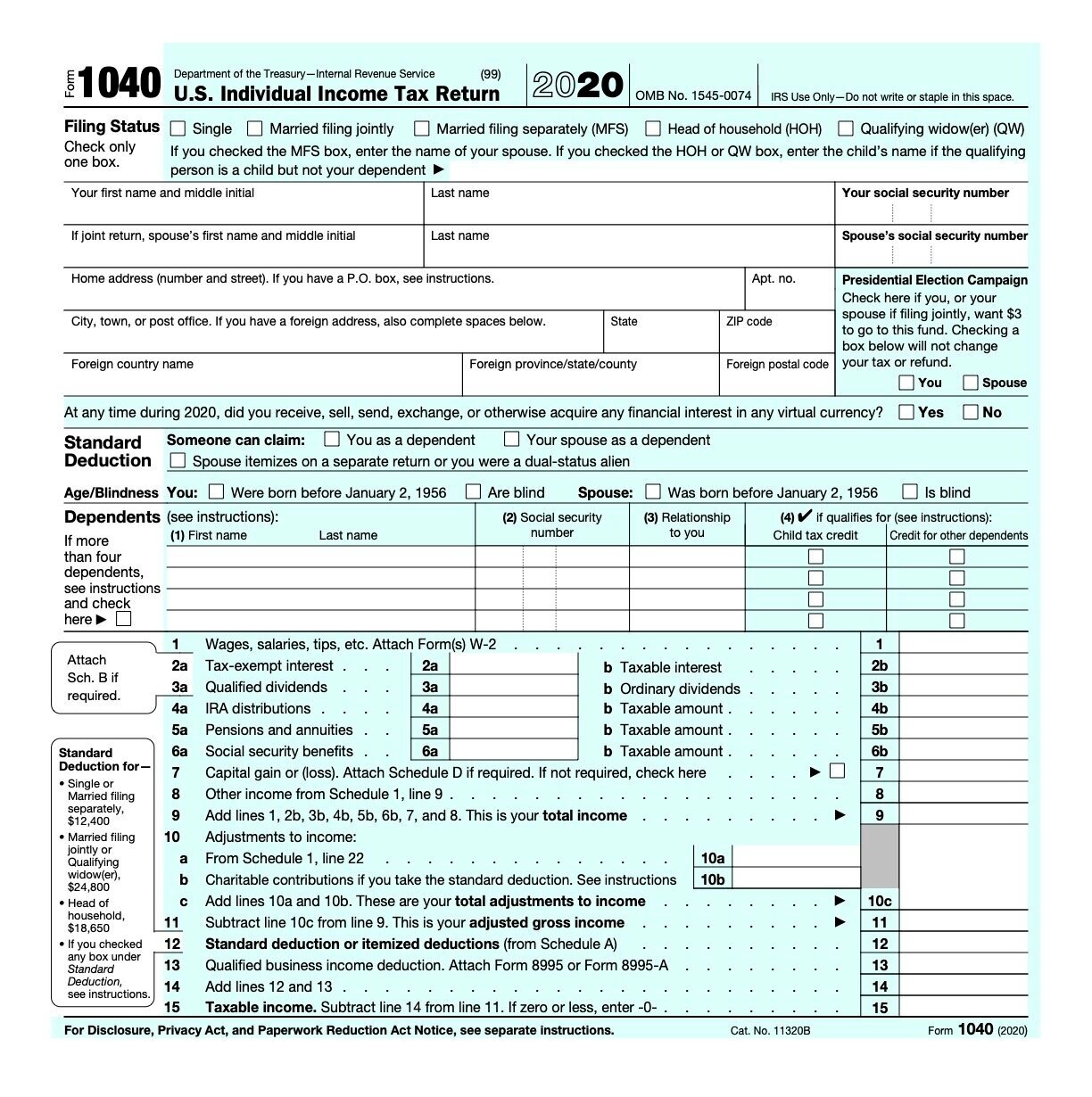

The 1040 Form

The 1040 form is the central document that organizes all of the key information from the multitude of other forms and schedules (more forms) that are used to document detailed tax issues. For example, a Schedule A form is used to document itemized deductions* such as medical expenses and property taxes. The total amounts calculated on the Schedule A form are then transferred to the appropriate line within the 1040 form. The IRS and states use a multitude of various forms. Each state that has state taxes also has its unique central form. For example, the New York central form is the IT-201 and the California central form is the 540.

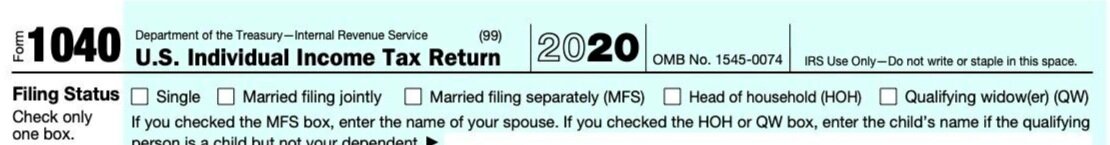

What is My Filing Status?

The first thing listed at the very top of the 1040 form is the filing status. It is important that you use the correct filing status because it can affect the amount of tax you owe for the year. Certain documentation is needed in order to support each filing status. The filing statuses, along with the documents required as proof, are as follows:

Single

Normally, this status is reserved for taxpayers who are not married, or who are divorced or legally separated under state law.[1]

Documentation required

A utility bill, for example, with only one name on it if you are filing your taxes as Single. If you are divorced or legally separated and filing as single, you will need to provide a bill with only your name on it, plus separation papers.

Tax Rates (current as of 2020 tax rules)[2]

Up to $9,950 in taxable income = 10% tax rate

$9,951 to $40,525 in taxable income = 12% tax rate

$40,526 to $86,375 taxable income = 22% tax rate

Married Filing Jointly

If taxpayers are married, you can file a joint tax return. The marital status is determined as of December 31st of the year for which you are filing your taxes. This means that you can get married on December 30th and still file a joint return for that year. If your spouse, unfortunately, passed away in the year for which you are preparing your taxes, you as the widowed spouse can still file a joint return for that year.[1]

Documentation required

A marriage certificate is required to report your taxes as Married Filing Jointly.Tax Rates (current as of 2020 tax rules)[2]

Up to $19,990 in taxable income = 10% tax rate

$19,991 to $85,050 in taxable income = 12% tax rate

$85,051 to $172,750 taxable income = 22% tax rate

Married Filing Separately

A married couple can choose to file two separate tax returns. This may benefit you if it results in less tax owed than if you and your spouse were to file a joint tax return.

There are multiple reasons to file separate tax returns. For example, if each partner wants to responsible for their own taxes, or if the couple is separated but not yet divorced. Taxpayers may want to prepare and calculate their taxes both ways before they choose—check with your tax preparer first.[1]

Documentation required

A marriage certificate.

Tax Rates (current as of 2020 tax rules)[2]

The tax rate for those who are Married Filing Separately is the same as the Single tax rates noted above.[2]

Head of Household

This status applies to a taxpayer who is married but separated and has, as a result, been living without their spouse for at least 6 months. To be considered Head of Household for tax purposes, and therefore unmarried on the last day of the year, you must meet the following criteria:

You must file a separate tax return;

You must have paid more than half the cost of keeping up your home for the tax year;

Your spouse must not have lived in your home during the last six months of the tax year. If your spouse is only temporarily absent, your spouse is considered to still be living in your home. Business or military separations are considered temporary separations and do not qualify;

Your home was the main home for more than half the year for a child who is under the age of 19, or 24 if they are a full-time student. The same applies to this status if your home was the main home and you provided half the cost and for:

(A) stepchild(ren)

(A) Foster child(ran)

(A) relative(s) who is/are permanently and totally disabled.[1]

Documentation required

You must provide:

Proof of typical household expenses;

Bills showing one person as living in the home;

Expenses for children such as a doctors bill or preschool bill;

Full-time student status of any children under the age of 24 (if applicable);

Disability documentation from a doctor if housing a relative with a condition (if applicable)

Tax Rates (current as of 2020 tax rules)[2]

Up to #14,420 taxable income = 10% tax rate

$14,421 to $54,200 taxable income = 12% tax rate

$54,201 to $86,350 taxable income = 22% tax rate

Qualifying Widow(er) with Dependent Child

This status may apply to a taxpayer if your spouse died during the year and you have a dependent child. The taxpayer must have been eligible to file a joint return with your spouse for the year during which your spouse died, although a joint return does not have to be filed. All that matters is that the taxpayer could have done so.The taxpayer's spouse must have died during either of the two immediately preceding tax years.

Additionally:

You the taxpayer cannot have remarried;

You must maintain a home for at least one dependent child. The child must be a son, daughter, stepson, or stepdaughter by blood or through adoption. This dependent must have resided with you the taxpayer for the entire tax year except for temporary absences, such as living away at school for a period of time.

You must have paid more than half the cost of maintaining the home for the year.[1]

Documentation required

The previous year’s tax return showing a joint return;

A death certificate,

Proof of a child under the age of 19, or age 24 if they are a full time student (include tuition status if applicable);

Typical household expenses for the year, such as doctors bills or preschool bills.

Tax Rates (current as of 2020 tax rules)[2]

Up to $19,400 taxable income = 10% tax rate

$19,401 to 78,950 taxable income = 12% tax rate

$78,951 to $168,400 taxable income = 22% tax rate

Remember, it is important to give your tax preparer the most complete information possible so the correct filing status is used. The filing status impacts your tax rate, the standard deduction, and of course, how much you ultimately pay or get in a refund.

Stay tuned for Part 2 of our “Be Prepared” series on tax preparation.

Share your comments at the bottom of the page.

© Whatismyhealth

*Revision July 25th, 2021 includes definition of itemized deductions.

A checklist of common documents related to deductions and credits that you will need when preparing to file your taxes for last year.