Be Prepared: Common Documents for Deductions and Credits

/DISCLAIMER: These articles are based on the tax requirements for 2020. Tax requirements change frequently so future requirements may be different. This article and future articles on this subject are not tax advice, they are meant to help you to know what documentation to prepare when submitting your information to your tax preparer. Always check with your tax preparer for the proper documentation required for that year and for any specific tax advice.

Part 8: Common Documents

for Deductions and Credits

As the title suggests, being prepared to do your taxes is important as it can save you time. It can also save you money. The organized documentation you give to your tax preparer, even if it you do your own taxes will make the work go faster and it will enable the correct calculation of your tax or refund. No sense paying too much or getting a smaller refund than you deserve.

Standard versus Itemized Deductions

You will automatically get the Standard Deduction if your total deductions are:

Less than $12,550 (Filing status: Single)

Less than $25,100 (Filing status: Jointly, or Head of Household)

If you do not fit into these categories, you or your tax preparer will need to itemize (list) your expenses to figure out your deductions. For many of the items, you may only need to provide the amounts you paid.

You’ll need to keep your own documentation for these expenses. You may need these documents as proof in the event that your taxes are audited. The IRS may perform an audit if they suspect you paid too little in taxes by reporting too many deductions.

Anyone can be audited within 3 years of a given tax return. Some audits can be done up to 7 years after a suspicious tax return is filed. It is a good idea to keep your records for at least 3 years, on average.

Gathering Your Expense Documents

It’s important to know what documents to gather and have ready as it gets closer to the deadline to submit your taxes. You also will need forms that show deductions for money you spent during the past calendar year.

Some deductions are reported on the Schedule A form. Other less commonly reported items are not listed on the Schedule A. There are other forms for documenting these items. You or your tax preparer will need to prepare the appropriate forms.

In our last post, we covered common income-related tax documents. Here, we will break down the common documents related to deductions and credits that you will need when preparing to file your taxes for last year, There is a checklist you can use to check that you have the common documents you need in order to prepare your taxes. You may need additional documents for each list. Not every document may apply to you.

Expenses Reported on the Schedule A Form

The following expenses will be reported on their own respective lines on a Schedule A form:

Mortgage Interest and Property taxes

If you have a home loan, the bank should send you a statement that reports the interest you paid. You need to keep your property tax receipts. Interest and taxes can be deducted, and they may reduce your income taxes.

Records you’ll need:

Bank statement reporting interest paid on your mortgage.

Your property tax bill.

Automobile Deductions

Portions of car registration fees may be tax deductible based on the amount of deductions on this schedule. Your annual registration statement should list the portion of the registration fee that is tax deductible.

If you bought an energy-efficient vehicle, such as one that runs on electricity, you may be eligible for a credit for an energy-efficient vehicle. The amount of the credit depends on the specific model and is based on the vehicle's fuel efficiency. You need to provide the cost and type of vehicle information.

Records you’ll need: Your annual vehicle registration statement. This statement will include the:

Make and model

VIN number

License plate number

Amount paid, and how much of that paid is tax-deductible

Charitable Deductions

If you make donations to any 501C3 charity, you may qualify for a charitable deduction. A 501C3 organization is a charity that has been approved by the IRS and enables contributions made to it to be tax deductible. Keep track of the charity’s name, address, and amount of each contribution you made throughout the year.

Records you’ll need:

The charity name, address you donated to, and how much you donated.

Proof of the donation payment. This can be a credit card statement, image of the check deposited, or hard copy receipt.

Education: Tuition and books

Paying for expenses like tuition and books adds up, but it can also put you in line for credits that save you money. The 1098 T (tuition statement) is sent to you by the education institution and shows the expenses you paid for tuition, fees, meal plans, etc., along with your scholarships and grants.

Records you’ll need: Form 1098 T, receipts from book purchases

Education: Student loan interest

This deduction lets you claim up to $2,500 of interest you paid on qualifying student loans. This will appear on the 1098 E, which will be sent to you by the university or loan servicer. To get this deduction, the student loan must be in your name.

Records you’ll need: Form 1098 E

Medical expenses

This deduction allows you to deduct a percentage of your qualified medical and dental expenses. Qualified medical and dental expenses include the cost of diagnosis or treatment to cure, improve or prevent a physical or mental illness or defect. They include costs such as:

Payments to or payments for services to doctors or dentists

Hospital fees

Some insurance premiums (including Medicare)

Prescription medications

Medical equipment and supplies

Personal protective equipment (PPE) (see below for more information)

Miles driven with your car for medical purpose

Records you’ll need:

Receipts from the above transactions

W-2 form. This should list your contribution to your insurance premiums

A mileage log for miles driven

Teachers

The Teacher (Educator) Expenses Deduction is for teachers, instructors, counselors, principals, or classroom aides who buy classroom supplies out of their own pocket up to $250. You must teach Kindergarten through grade 12 and work at least 900 hours per school year to be eligible. People who home-school their children are not eligible for this deduction.

Expenses that are considered common, accepted, and appropriate for your job as an educator count. These include:

Books

Supplies

Computer equipment and software

Other equipment and supplementary materials you use in the classroom

For example: Hanna teaches 5th graders at an elementary school. She buys books, paper, markers, scissors and tape for her classroom. Hanna worked over 900 hours during the past school year. She is eligible for the Teacher Expenses Deduction.

Records you’ll need: know the total spent, receipts from items listed above

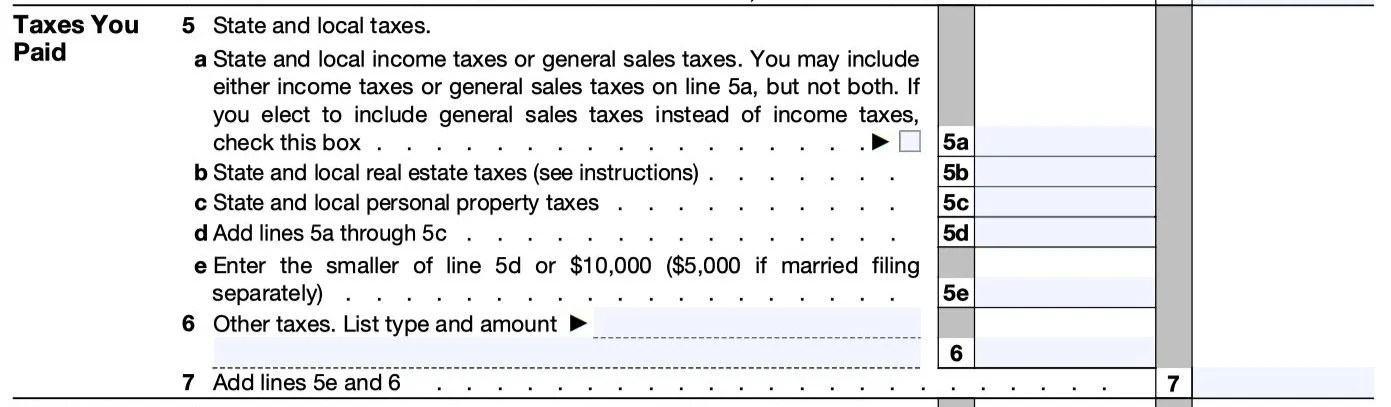

State and local taxes OR state income taxes

You have the option of claiming either general state and local sales taxes, OR state and local income taxes as an itemized deduction. Either can be used to reduce your tax bill. You must keep track of your sales taxes to claim this deduction. Keep all purchases that show the sales taxes paid.

Records you’ll need: Receipts from all purchases on which you paid sales tax.

Job-related expenses

You may be able to deduct items required by your employer that you pay for out of your own pocket. Items like tools or boots may be eligible for this deduction. Keep track of each of these expenses.

Records you’ll need: Receipts for each of the items listed

Tax preparation fees

These fees may be deductible. Your payment to the tax preparer is the document required.

Records you’ll need: receipt from tax preparer for the corresponding year of fees paid for tax prep.

Expenses Not Reported on the Schedule A Form

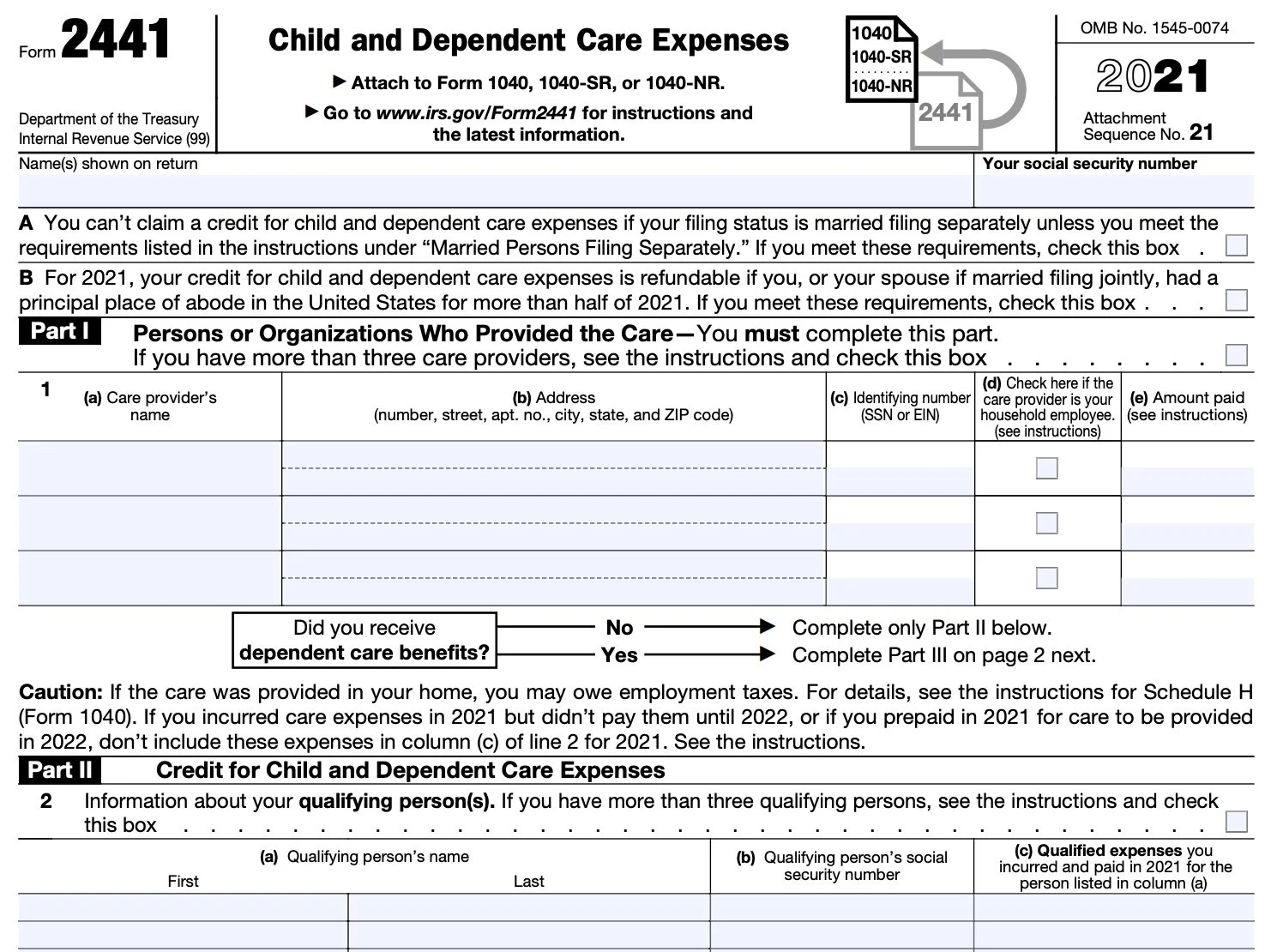

Child and Dependent Care Credit

If you paid someone to care for your child (or your disabled spouse or another dependent) while you work, you might be eligible to receive a tax credit. This tax credit will reduce your taxes, and is a percentage of your child or dependent care expenses. It will vary depending on your adjusted gross income (AGI).

You can claim expenses used to care for your child or dependent, such as day care, nursery school costs, wages paid to a household employee (such as a nanny), and payments to a babysitter, maid, or cook if the payments are made for your child or dependent's wellbeing. Your tax preparer will tell you if you qualify for this credit. If you do, these will reduce your taxes owed.

Records you’ll need: Record of payments made to a daycare center, nanny, household employee, etc.

For further information, visit: About Form 2441 | Form 2441

Earned Income Credit

If you have children under age 19 (or under age 24 if they are a full-time student), and you make less than $57,000 per year, you may qualify for this credit. To claim this credit, you must have either a Social Security number (SSN) or a taxpayer identification number for each child.

Records you’ll need:

W-2 Form if you make under $57,000 (this is proof of your salary)

The SSN of the child(ren) should already appear on the 1040.

For further information, visit: About Schedule EIC | Schedule EIC form

Individual Retirement Deduction (IRA)

You may qualify for the IRA deduction if you made a regular contribution to a traditional IRA that is not a rollover contribution. You must have earned income equal to or greater than the amount of your contribution. The institution where you keep your IRA will send you an annual contributions statement.

A rollover is when you transfer funds from one IRA to another, or from a tax-deferred plan, such as a 401(k) plan, to an IRA. You (or your spouse, if filing a joint return) must have earned income, such as wage, salary, or self-employment earnings. You must show evidence of the rollover within 60 days to avoid a penalty and paying tax on the amount you withdrew.

Records you’ll need: Annual contributions statement (this will be sent by the institution paying the IRA).

For further information, visit: About Form 5498 (IRA Contribution form) | Form 5498 (IRA Contribution form)

Moving expenses

This deduction allows you to deduct certain moving expenses when you relocate. Your move must be business-related, such as moving to take a new job, or moving because of a business transfer. You can deduct the cost of your move and the cost of storing your personal property during the move.

You can also deduct travel and lodging expenses for yourself and your family during the move.

Records you’ll need: Receipts for:

Payments made to a shipping company

Supplies paid for the move

Gas for travel

Hotel expenses

Restaurant expenses

For further information, visit: About Form 3903 | Form 3903

Casualty and Theft Deduction

You might qualify for this deduction if your personal property is damaged because of a federally declared disaster, such as a storm, flood, fire, car accident, or similar event, or if your property is stolen. You need to prove that your property is in the disaster area, (via link below).

Property includes anything you own. Due to the high limits on this deduction, people most often claim this deduction for losses related to their homes, vacation homes, vehicles, and other big-ticket items such as boats and recreational vehicles. You can also claim this deduction for losses related to property used in a business.

See www.DisasterAssistance.gov for assistance.

For further information, visit: About Form 4684 | Form 4684

Alimony

If you paid alimony to a spouse or former spouse to whom you were legally married, you can deduct it on your tax return. There is no limit to the amount of alimony you can deduct.

Eligibility requirements

You must be divorced or legally separated from the spouse to whom you make the payments. The year of this decree must be before January 1st, 2019.

You and your spouse (or former spouse) cannot be members of the same household at the time you made the alimony payments.

Your spouse (or former spouse) must include the alimony payments or separate maintenance payments as income on their tax return. If they do not claim them as income, you cannot claim them as a deduction. If you are audited, and both are not met, your deduction would be disallowed, or the party reporting the income would have their income be disallowed.

You must pay the alimony within the year in which you're taking the deduction. If you plan to take the deduction for 2021, you must have paid the alimony in 2021.

Items that are not deductible include:

Child support payments

Property settlements you made because of a divorce

Legal fees you paid to defend yourself in an alimony suit

Payments you made voluntarily (e.g. a monetary gift) that are not specifically identified in a divorce or separate agreement as alimony

Payments you made to maintain your spouse’s (or former spouse’s) house or other real estate.

Records you’ll need:

Divorce papers stating the amounts of the alimony

Evidence of payments

For more information, visit: Schedule 1

Being (and Staying) Prepared

From year to year, it is a good idea to keep track of income and expenses, and hold onto the documents to show what you learned and what you’ve spent. This will make it easier to prepare your taxes.

You might keep a file folder for things like receipts, pay stubs, mortgage payments, and bills. This will help keep you organized so that you don’t have to find a year’s worth of documents at the last minute when trying to file your taxes.

If you are having your taxes prepared for you by a tax professional, ask them what other documents you may need. If you are preparing your own taxes using a free software program to assist you, the program may prompt you to record these common documents.

We recommend that only an experienced tax professional prepare your taxes by hand; taxes can be quite complex, with many forms that relate to one another.

Share your comments at the bottom of the page.

©Whatismyhealth

Special acknowledgements to TurboTax, and to our references:

https://en.wikipedia.org/wiki/Sales_taxes_in_the_United_States#By_jurisdiction

https://www.irs.gov/forms-pubs/about-form-2441

https://www.irs.gov/pub/irs-pdf/f2441.pdf

https://www.irs.gov/forms-pubs/about-schedule-eic-form-1040

https://www.irs.gov/pub/irs-pdf/f1040sei.pdf

https://www.irs.gov/forms-pubs/about-form-5498

https://www.irs.gov/pub/irs-pdf/f5498.pdf

https://www.irs.gov/forms-pubs/about-form-3903

https://www.irs.gov/pub/irs-pdf/f3903.pdf

https://www.irs.gov/forms-pubs/about-form-4684

A checklist of common documents related to deductions and credits that you will need when preparing to file your taxes for last year.