Be Prepared: Standard Deductions

/DISCLAIMER: These articles are based on the tax requirements for 2020. Tax requirements change frequently, so future requirements may be different. This article and future articles on this subject are not tax advice, they are meant to help you to know what documentation to prepare when submitting your information to your tax preparer. Always check with your tax preparer for the proper documentation required for that year, and for any specific tax advice.

Be Prepared (Part 2):

Standard Deductions

As the title suggests, being prepared to do your taxes is important, as it can save you time. It can also save you money. The organized documentation you give to your tax preparer, even if you do your own taxes will make the work go faster and it will enable the correct calculation of your tax or refund. No sense paying too much, or getting a smaller refund than you deserve.

Key Terms used in this article, and other articles in this series:

Deductions

Think of deductions like expenses. Deductions reduce your income and then the appropriate tax rate is applied to the difference between your income and your deductions.

Itemized Deductions

These were referred to in Part 1 as the expenses listed on the Schedule A form. These include medical expenses and property taxes, state taxes, donations (referred to by the IRS as contributions) of money, clothes, furniture, or other assets to non-profit organizations, among other smaller level items.

Standard Deduction

Each filing status is given a predetermined deduction called the standard deduction. Deductions over that amount can be used to reduce the taxable income. If the taxpayer does not have more deductions than the standard, then the standard is used.

Filing status

One of the five different methods of how the IRS has categorized individual tax situations.

Income

The wages, interest, dividends, and other sources of money you receive during the year.

Legally blind

The IRS defines legal blindness as being unable to see better than 20/200 in your better eye even with corrective eyeglasses or contacts or having a field of vision less than 20 degrees.

Tax year

A tax year is determined by the time you first file your taxes; if you filed your taxes for the first time starting in August, then August to July would become your tax year.

Short tax year

A short year is a change to the accounting period. If you are filing a tax return for a short tax year because of a change in your annual accounting period, you may become ineligible for the standard deduction.

What is the Standard Deduction?

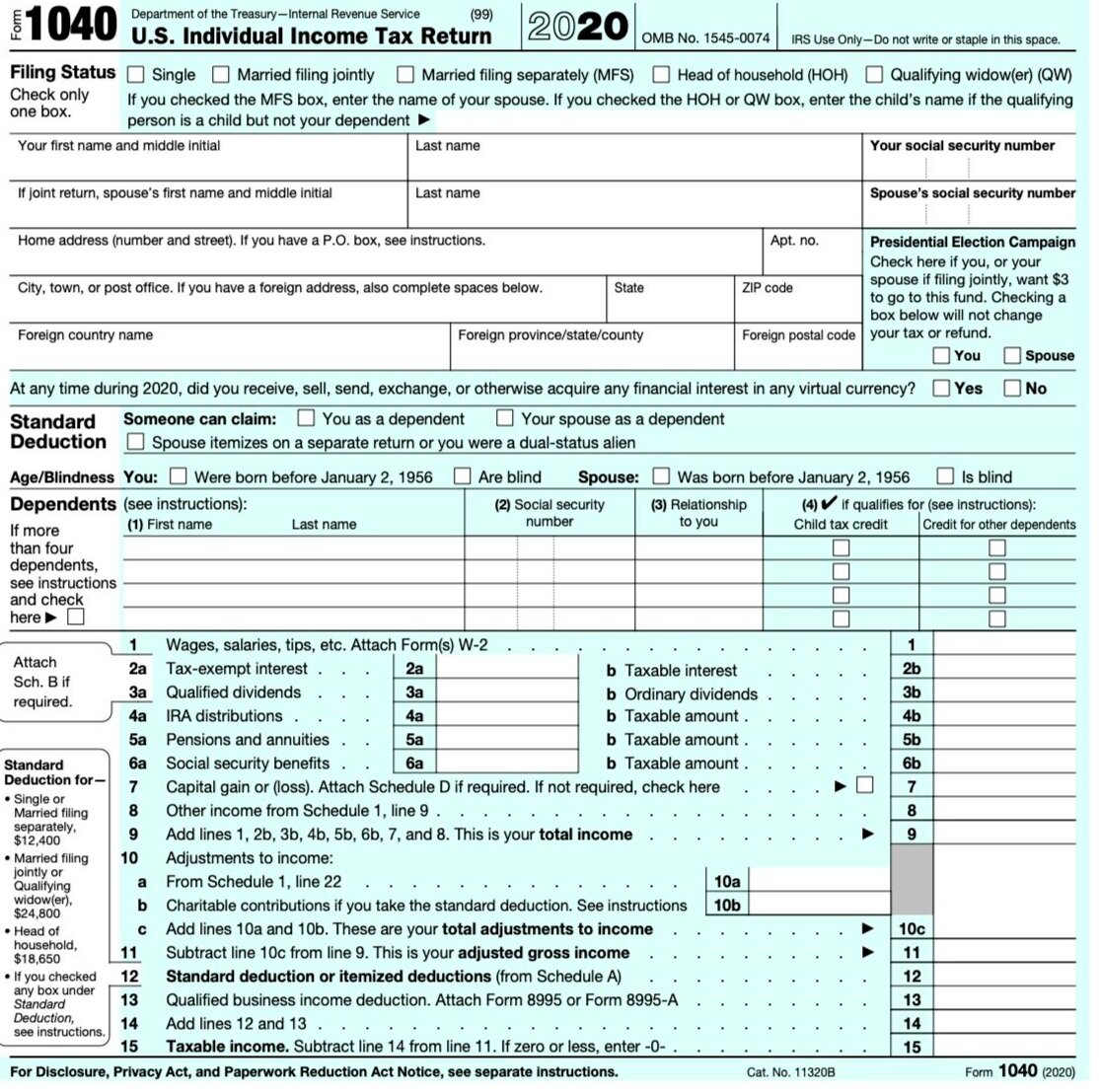

In the last post, we covered the 1040 form, the central document that organizes all the key information from other forms and schedules that are used to document detailed tax issues. The totals from these forms are transferred to the 1040. We also covered filing status, which affects the amount of tax you owe for the year.

The next item on the 1040, after filing status, is the Standard Deduction. The importance of the Standard Deduction is that is subtracted from your income. As a result, this may lower the amount of taxes you owe.

Some tax preparers will also talk about deductions as expenses. If your itemized deductions (the expenses listed on Schedule A) are greater than the Standard Deduction, you should use Schedule A and itemize your deductions instead of the Standard Deduction. The Standard Deduction amount depends on your filing status, whether you are 65 or older or blind, and whether another taxpayer can claim you as a dependent. Generally, the standard deduction amounts are adjusted each year for inflation.

The base Standard Deduction is dependent on filing status:

Filing Status Deduction Amount

Single or Married filing separately. $12,400

Married filing jointly or Qualifying widow(er) $24,800

Head of household $18,650

There may be additional increases to the standard deduction dependent on certain criteria. For instance, if you are 65 years or older, the standard deduction will increase. There are also increases to the standard deduction for individuals who are legally blind. If you are married filing jointly, and/or over the age of 65, and/or legally blind, your standard deduction threshold may further increase based on a combination of these criteria. For example:

If you are filing as single and are 65 years or older, the standard deduction is $14,050;

If you are filing as single, are 65 years or older, and are also blind, the standard deduction is $15,700;

For married couples filing jointly who are both 65 years or older, the deduction is $27,400.

Ineligibility Criteria: Persons Ineligible for the Standard Deduction

There are a few circumstances in which you may be ineligible for the standard deduction:

Married Filing Separately with a spouse who itemizes their deductions

If your filing status is married filing separately, and your spouse itemizes deductions on his/her/their return, you are ineligible to receive the standard deduction. This is because a married couple can only be allowed one set of deductions in total, either itemized or standard.

Short Tax Year

If you are utilizing a shortened tax year, you may be ineligible for the standard deduction. This is usually done for business purposes.

For example, let’s say you have used a regular calendar year (January to December) in the past, but when filing your taxes for this year (2021), you wish to switch from September to August for business reasons. When filing taxes for 2021, this would be considered a short year—January 2021 to August 2021—and you would file your tax return for that period. Next year, you would then file your taxes for September of 2021 through August of 2022.

If you file your first tax return using the calendar tax year (January to December), and you later begin business as a sole proprietor, become a partner in a partnership, or become a shareholder in an S corporation, you must get IRS approval to change your tax year, or meet one of the exceptions listed in the instructions.

You can file Form 1128, Application To Adopt, Change, or Retain a Tax Year (PDF) to seek approval for the change in tax year. Once you have adopted your tax year, you may have to get IRS approval to change it. To get approval, you must file Form 1128 (PDF).

Non-residents or Dual-Status Aliens

If you are a nonresident or dual-status alien during the year, you are not eligible for the standard deduction. You are considered a dual-status alien if you were both a nonresident and resident alien during the tax year.

If you are a nonresident alien who is married to either a U.S. citizen or resident alien at the end of the year, you can choose to be treated as a U.S. resident. If you make this choice, you can take the standard deduction. Any of these distinctions will require documentation, which is outlined below:

Documentation needed:

Married filing jointly: Marriage certificate

Qualifying Widower: Death certificate and marriage license. See Part 1 for further details.

Head of Household: See Part 1 for further details.

Over 65: Government ID with birth date listed.

Legally blind: Statement of legal blindness certified by registered optometrist or eye doctor. This documentation must accompany your tax filing.

If you meet any of these criteria, it is recommended that you itemize your tax deductions using the Schedule A form.

Stay tuned for Part 3 of our “Be Prepared” series on tax preparation.

Share your comments at the bottom of the page.

© Whatismyhealth

A checklist of common documents related to deductions and credits that you will need when preparing to file your taxes for last year.