Being a Smart Banking Consumer: Savings Accounts

/Banks are a place for us to handle our checking, savings, and possibly a loan. Beyond that, for many of us banking is a black hole. Why banks do what they do and how they do it is little understood outside of the banking community.

The more information you have, the better consumer you can be.

Being a Smart Banking Consumer

(Part 5): Savings Accounts

This post is a follow-up to last month’s article on bank accounts. The previous post dealt with checking accounts, now we’ll focus on savings. Every bank has different names for these accounts, but generally, they are all basically limited to two main types, savings accounts and certificates of deposit (CDs). Generally, opening only savings and CD accounts will not give you extra perks like cashier’s checks and a free safe deposit box. These perks are usually reserved for when opening a checking account.

Before we dive to these accounts, let’s talk a little bit about the Federal Reserve.

The Federal Reserve (The FED)

The FED is responsible for several important functions when it comes to money. It is responsible for keeping unemployment rates low and keeping inflation at, or below 2% per year. The one we are most interested in as consumers is the raising and lowering of interest rates.

Most financial instruments, including bank accounts, are tied to the FED interest rate level. The ability to raise and lower rates is a powerful tool. This ultimately effects everyone’s saving and borrowing.

When the economy is losing steam and unemployment rates are rising, the FED will attempt to stimulate the economy by lowering interest rates. The implication is that with lower interest rates, companies and consumers will borrow and spend more money, which will create more jobs.

When the economy is so strong that there is a tendency for prices to go above the 2% inflation level, the FED will raise interest rates in order to “slow things down" and keep inflation at its target 2% rate. Again, the idea here is that the higher the interest rates, the less people will borrow and spend.

Now, let’s talk about accounts.

Savings Accounts

Savings accounts allow consumers to park their money in an account that earns interest. The purpose of these accounts is to save money for the long-term, emergencies, or special occasions. Different from a checking account, savings accounts only allow six withdrawals a month, just like money market accounts. This is due to federal regulations that classify both money market accounts and savings accounts in a similar category.

Under federal regulations, you can sometimes be required to give the bank seven days’ notice before you withdraw money from savings accounts. While banks rarely enforce this rule, it can be enforced in what is called a “run on the bank.” This happens when the public loses confidence in a bank for any number of reasons and hundreds, if not thousands of people demand their money at the same time.

As was discussed in our first article, banks rarely have more than 1 to 3% of the total cash deposited by consumers on hand. In order to make a profit, the bank must loan your money to consumers and businesses. The bank lends this money at a higher rate of interest than it pays on all types of checking and savings accounts.

Why savings accounts?

A question you may ask is, Why not keep my money in a checking account, as some of these also pay interest— why bother with a savings account?

The answer is simple: basic human psychology.

Checking accounts are commonly used to pay bills. Therefore, keeping money only in a checking account “allows” most people to spend that money in this way. For many people, putting money in a savings account has a different feeling and purpose— that is, to save this money.

How can I access my savings accounts?

Savings accounts can be accessed directly at a bank, or through the ATM. Savings accounts are indefinite— they have no specific time period, as compared to Certificates of Deposit (see below). The interest rate on a savings account may change based on how the FED changes interest rates.

For example, if the Federal Reserve raises interest rates by 1%, the interest rate on many savings-type accounts will also increase. However, banks may only raise the interest on accounts that draw interest by a quarter of a percent. They may also delay this increase by a month or two after the rate increase by the Federal Reserve. On the other hand, loans that are tied to the Federal Reserve rate will be increased the full 1%. Of course, the purpose of this is to help the bank profit.

Certificates of Deposit (CDs)

A Certificate of Deposit is a type of savings account that has a fixed time period. This can range from one month to five years. CDs also have a fixed interest rate over that time period.

During a CD’s fixed time period, your money cannot be withdrawn; withdrawing your money early will result in a penalty. The amount of the penalty varies between banks. You can find these penalties outlined in the bank’s fee schedule, which you should receive at the time you open an account. Make sure you read the fee schedule, as it will list all the bank’s various fees.

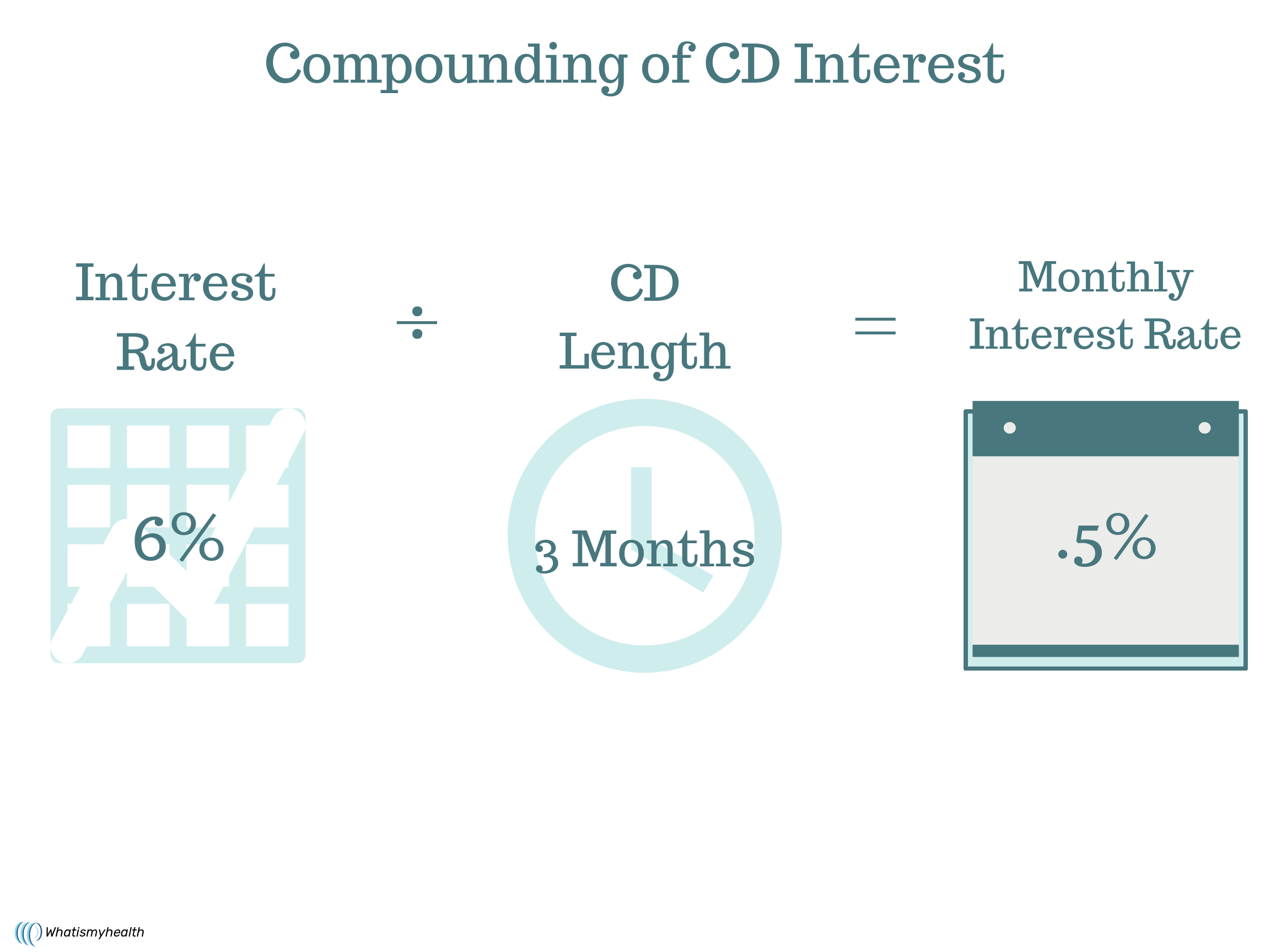

A CD’s interest rate will be stated in two ways: 1) the interest rate, and 2) the Annual Percentage Rate (APY). The APY will always be slightly higher than the interest rate.

For example, if you have a 12-month CD, and the interest rate is 6%, the APY will be 6.16%. These bank percentages are always stated as annual rates. Since CDs are fixed and you cannot withdraw the money each month (without paying a penalty), the additional interest earned is added to the balance at the end of each month. In other words, as interest is earned, the value of the CD grows each month. That new higher value then earns more interest in the following month. This is called compounding.

The detail behind the calculations are not necessarily important to most consumers here. If you’re interested in reading more about it, you can refer to this infographic. The main thing to know is that when you shop for CDs, it's best to compare the APY on the different accounts, not the interest rates.

At maturity, (the end of the fixed time period) a CD will have a seven-day grace period that allows you to add more money to the account for the next fixed time period. The bank will send you a notice that states the new maturity date, new time period, and the new interest rate if you decide to “rollover” the account. That is, you can keep the account in the bank for another fixed period of time if you so choose. If not, you can withdraw your money from the CD and do with it what you please.

Up next in part 6, we’ll take a look at some common types of banking transactions.

Whatismyhealth © 2019

A checklist of common documents related to deductions and credits that you will need when preparing to file your taxes for last year.