Be Prepared: Pensions, Annuities, and Social Security

/DISCLAIMER: These articles are based on the tax requirements for 2020. Tax requirements change frequently so future requirements may be different. This article and future articles on this subject are not tax advice, they are meant to help you to know what documentation to prepare when submitting your information to your tax preparer. Always check with your tax preparer for the proper documentation required for that year and for any specific tax advice.

Be Prepared (Part 6)

Pensions, Annuities, and Social Security

As the title suggests being prepared to do your taxes is important as it can save you time. It can also save you money. The organized documentation you give to your tax preparer, even if it you do your own taxes will make the work go faster and it will enable the correct calculation of your tax or refund. No sense paying to much or getting a smaller refund than you deserve.

In this post, we will discuss regular payments made through pensions and annuities, as well as social security benefits, as they relate to tax preparation.

Pensions

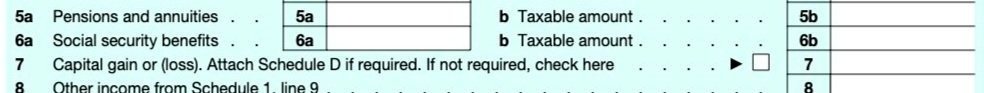

A pension is a series of determinable payments made to you after you retire from work, or are disabled and cannot work. Pension payments are made regularly and are based on such factors as years of service and prior compensation. Pensions are reported on line 5a of the 1040 Form.

Disability pensions

One common type of pension is a disability pension. With a disability pension, you receive disability payments if you retired on disability, but haven't reached minimum retirement age. The condition that keeps you from working must last at least at least one year. A social security disability pension can be obtained by applying to the Social Security Administration.

Annuities

An annuity is a series of payments, under a contract from an insurance company, made at regular intervals over a period of more than 1 full year. They can be either fixed (under which you receive a definite amount) or variable (not fixed). You can buy this contract alone, or with the help of your employer. Annuities are reported on line 5b of the 1040 Form.

Types of annuities

The most common types of annuities include the following:

Fixed-period annuities

With a fixed-period annuity, you receive definite amounts at regular intervals for a specified length of time. Monthly payments are the most common, but other choices may be available depending on the payer of the annuity.

Annuities for a single life

You receive definite amounts at regular intervals for life. The payments end upon death.

Joint and survivor annuities

Joint and survivor annuities can be held by no more than 2 people. The person who originally owned the annuity is listed first; a second person may be covered by the annuity. When a second person is listed, the first annuitant receives a definite amount at regular intervals for life. After he/she/they die, a second annuitant receives a definite amount at regular intervals for life. The amount paid to the second annuitant may or may not differ from the amount paid to the first annuitant.

Variable annuities

With variable annuities, you receive payments that may vary in amount for a specified length of time, or for life. The amounts you receive may depend upon such variables as profits earned by the pension or annuity funds, cost-of-living indexes, or earnings from a mutual fund.

Documenting pension and annuity payments

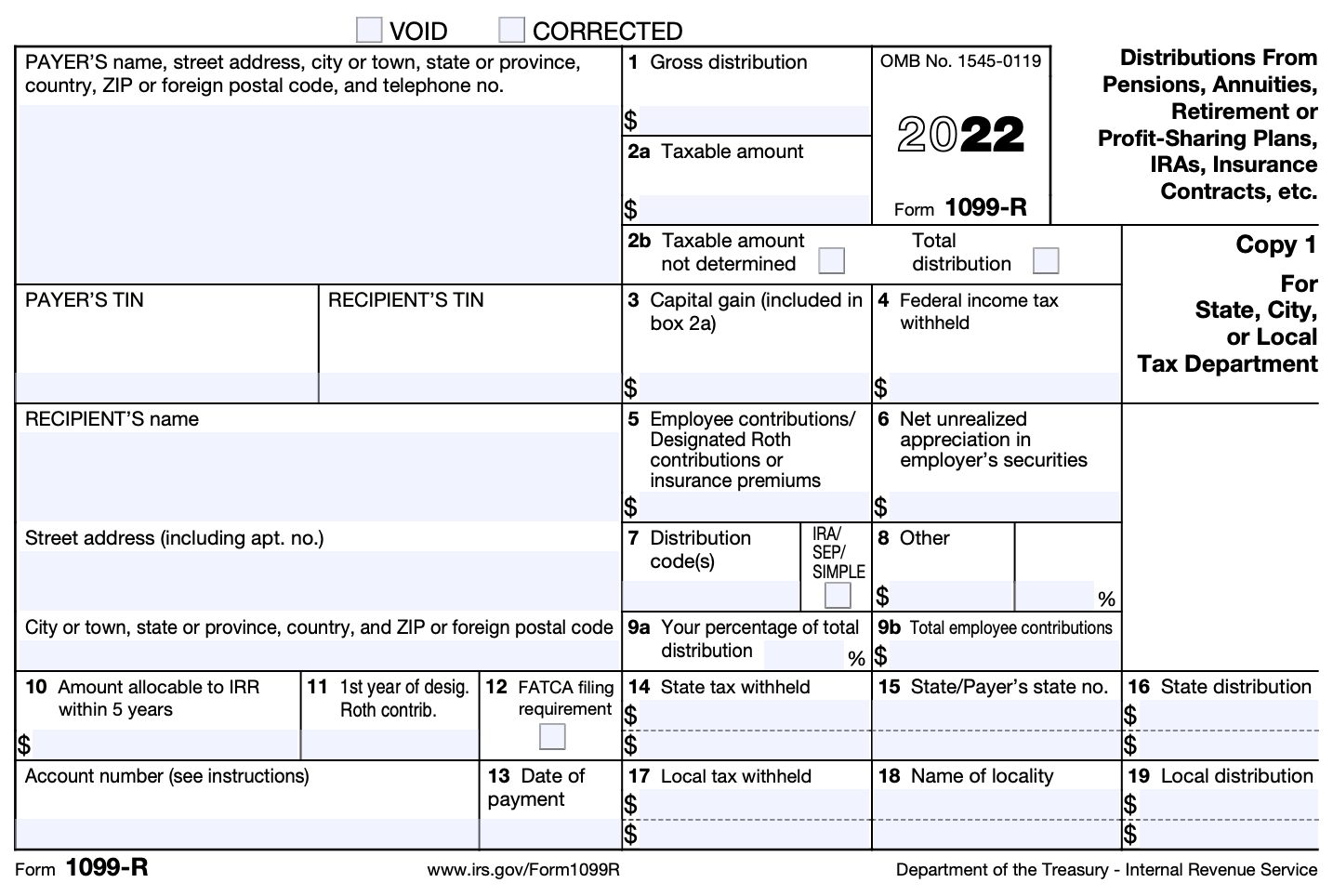

Documentation required: 1099R Form

Distributions from Pensions, Annuities, Retirement or, Individual retirement accounts (IRAs) are reported on the 1099R. It is a source document that is sent to each person that receives a distribution of $10 or more from annuities, pensions, permanent and total disability payments.

The most important boxes in the 1099R for most people are:

Box 1- Shows the total or gross amount that was distributed to the taxpayer this tax year.

Box 2a- Shows the portion of the distribution which is generally taxable.

Box 2b- Contains two boxes which can be checked, which provide information from the payer about the distribution. Checking the first box indicates that you were unable to determine the taxable amount; in this case, Box 2a should be left blank. If the second box is checked, the distribution was a total distribution and closed out the account.

Box 4- Shows any federal income tax withheld when the distribution was received by the taxpayer.

Box 7- Displays a distribution code which identifies the type of distribution that was received. For example:

Social Security Benefits

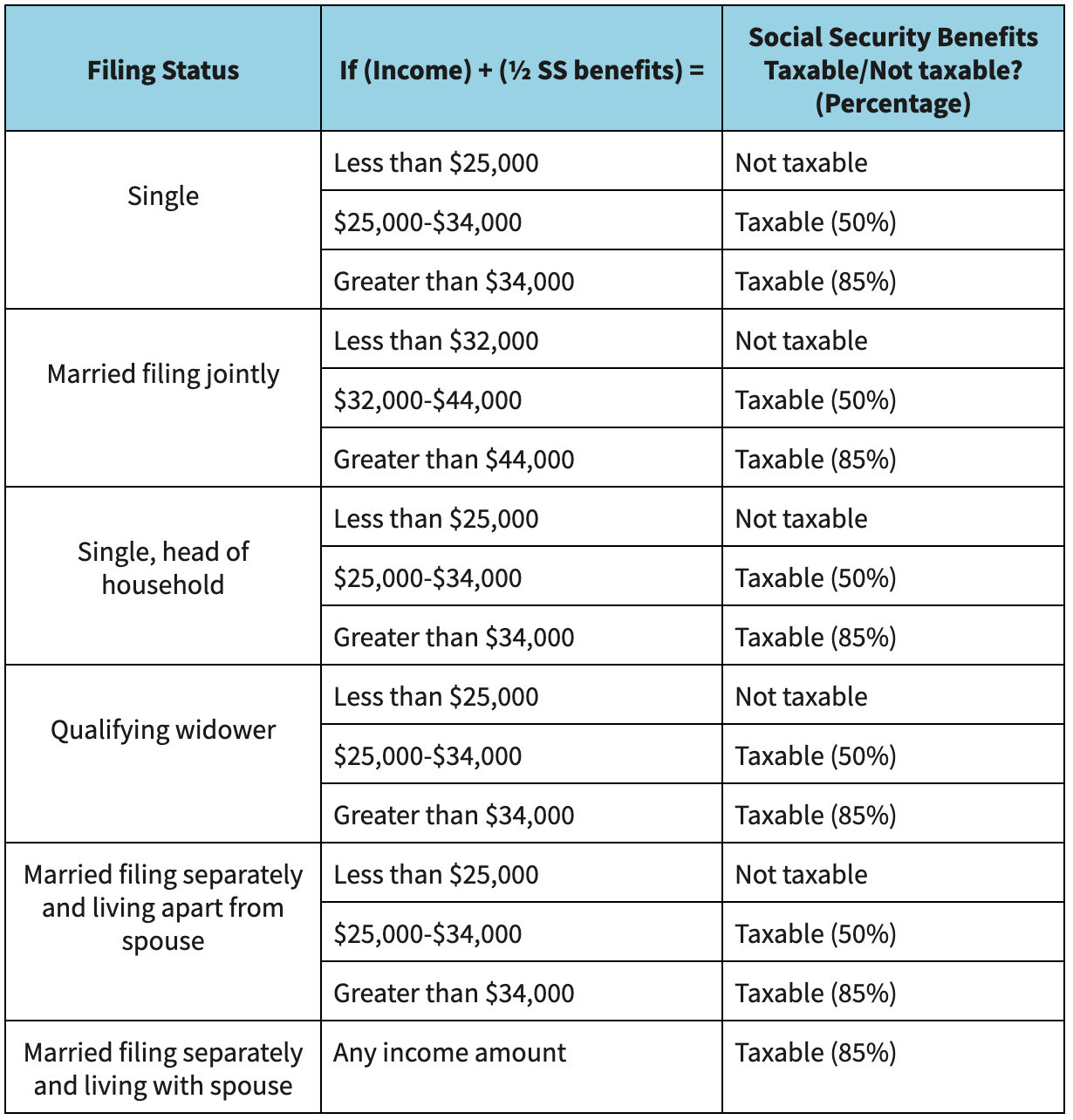

Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Social Security benefits include monthly retirement, survivor, and disability benefits. They do not include supplemental security income payments, which may be granted to low-income individuals who can prove they are unable to work for over a year due to a disability; these payments are not taxable.

Whether your social security payments—and what percentage of them—are taxable depends upon your (1) filing status, and (2) your total income, plus one-half of the Social Security money you collected during the year.

Documentation required: SSA 1099 Social Security Statement received from the Social Security Administration.

Stay tuned for Part 7 of our “Be Prepared” series on tax preparation.

Share your comments at the bottom of the page.

© Whatismyhealth

A checklist of common documents related to deductions and credits that you will need when preparing to file your taxes for last year.