Be Prepared: Interest, Dividends and Distributions

/DISCLAIMER: These articles are based on the tax requirements for 2020. Tax requirements change frequently so future requirements may be different. This article and future articles on this subject are not tax advice, they are meant to help you to know what documentation to prepare when submitting your information to your tax preparer. Always check with your tax preparer for the proper documentation required for that year and for any specific tax advice.

Be Prepared (Part 5)

Interest, Dividends and Distributions

As the title suggests being prepared to do your taxes is important as it can save you time. It can also save you money. The organized documentation you give to your tax preparer, even if it you do your own taxes will make the work go faster and it will enable the correct calculation of your tax or refund. No sense paying to much or getting a smaller refund than you deserve.

In this post, we will discuss investments and their yields, and how these returns factor into tax preparation.

Key terms that will be used in this and other articles:

Municipal Bonds

These are debt instruments issued by state and local governments, usually for large, expensive, and long-lived capital projects such as sewer lines and wastewater treatment plants. These bonds can take anywhere from a year to thirty years to mature.

Taxable interest received

Interest on investments that can be taxed.

Non-taxable interest received

Interest on investments that cannot be taxed.

Dividend

A distribution of a portion of a company's earnings, decided by the board of directors. The purpose of dividends is to return wealth back to the shareholders of a company.

Ordinary Dividends

Dividends taxed at the taxpayer’s wages rate.

Qualified Dividends

Dividends that are taxed at a lower tax rate.

Mutual fund

A professionally managed pool of investments from many investors.

IRA (Individual Retirement Account)

A long-term account that allows for contributions which reduce your annual taxable income.

Distribution

Money removed from an IRA account.

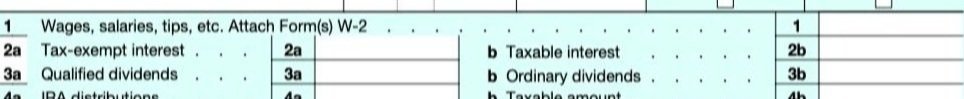

1040 Form Lines 2a and 2b: Interest

Line 2a on the 1040 form is for tax-exempt interest; line 2b is for taxable interest. Tax exempt interest is received from municipal bonds. The U.S. federal tax rules have always exempted interest payments from municipal bonds from taxable income. Municipal bond interest is not subject to federal income taxes, however, it may be subject to state income taxes depending upon your state of residence.

In effect, when a U.S. taxpayer receives interest income from a municipal bond, the bond interest is reported as tax-exempt interest and excluded from Schedule B of the Form 1040 tax return. Schedule B is used to report taxable interest over $1,500 received for the year.

Documentation required: Form 1099-INT, which is sent to the taxpayer from the interest-paying entity. This form includes both taxable and tax-exempt interest for both federal and state purposes.

1040 Form Line 3a and 3b: Dividends

Documentation required: Form 1099-INT.

Dividends are paid to shareholders of certain companies. These dividends are a distribution of a portion of a company's earnings, which is decided by the board of directors. The purpose of dividends is to return wealth back to the shareholders of a company.

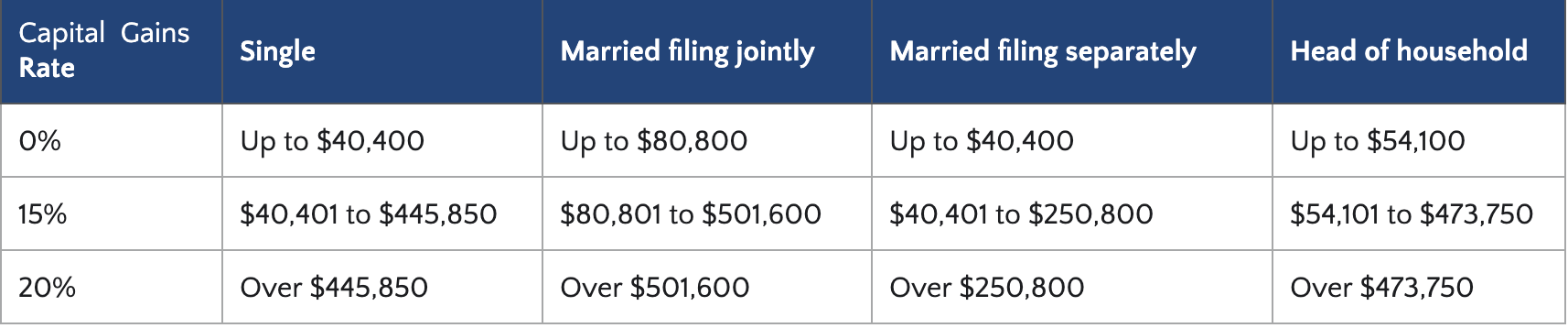

Ordinary dividends are taxed at the same rate as you, the taxpayer’s wages; Qualified dividends are taxed at the Capital Gains rate. An example of a qualified dividend company would be a mutual fund that invests in municipal bonds that are tax exempt. A mutual fund is a professionally managed pool of investments from many investors. Since all the earnings of this type of company are tax exempt interest from the bonds, then any dividends that it pays would be taxed to you at the lower capital gains rate. So, if the company sending the dividend generates that dividend from tax exempt income, then the dividend sent to you is qualified and taxed at the lower Capital Gains tax rate.

The Capital Gains rate is the rate that you would pay if, for example, you sold your car and you made a profit on the sale. Cars and other assets, such as machinery and furniture, are considered capital assets and are taxed at a lower rate than wages when sold for a profit. The rate you pay depends on your taxable income.

For example, per the table above, if you are single and your taxable income is between $40,401 and $445,850, you would pay 15% on any qualified dividends. (I assume that most of us are in this level, or the 0% level. If you’re in the higher level, congratulations.) At the end of the year, the company sending you the dividend will send you a Form 1099-INT. The 1099-INT includes information on both types of dividends received.

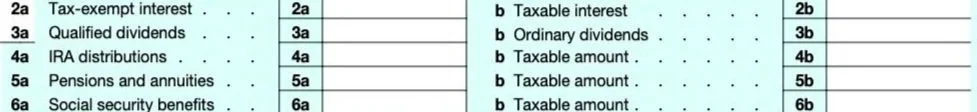

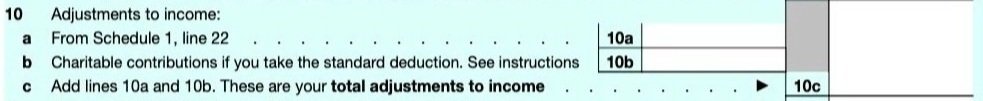

1040 Form Lines 4a and b: IRA Distributions

Individual Retirement Accounts (IRA) are a form of retirement savings account. As of 2021, IRAs allow you to contribute up to $6,000 for the year. This amount is a deduction and will be deducted from your taxable income. This deduction is reported on Schedule 1, line 19, which you, or your tax preparer, will add to your tax return. Line 10a of the 1040 is where the totals of Schedule 1 are reported as an adjustment to your income. In the case of an IRA contribution, this is a subtraction from your income.

On the 1040, lines 4a and 4b report IRA distributions. A distribution is when you take money out of your IRA account. Line 4a reports the amount that is not taxed; line 4b reports the amount that is taxed.

How much you will pay in taxes when you withdraw money from an IRA depends on your age, and even the purpose of the withdrawal. Sometimes, the answer is zero—you owe no taxes. In other cases, you may owe income tax on the money you withdraw. You might even owe an additional penalty if you withdraw funds before age 59½. On the other hand, after age 72½, you will be required to withdraw some money every year and pay taxes on it.

If you withdraw money before age 59½, you will have to pay income tax, and even a 10% penalty, unless you qualify for an hardship exception. These are listed under “Hardship Exceptions" later in this post.

At age 72, you are required to withdraw money from every type of IRA but a Roth—whether you need it or not—and pay income taxes on it.

You can avoid the early withdrawal penalty, however, all distributions will be added to line 4b and included in taxable income.

Hardship exceptions

Qualified education expenses

Tuition, books, tutoring, and computers are some examples of qualified education expenses.Documentation required: Examples include receipts for books and statements from the college showing tuition payments.

First-time home purchase

This also includes you withdrawing money to help your children, spouse, parent, or grandchild purchase a home for the first time. The maximum amount you can withdraw tax-free is $10,000.

Documentation required: Examples include home purchase documents such as the loan documents from the bank, the mortgage deed, and the escrow statement.

Disability of the IRA owner

Documentation required: Medical records showing disability.

Death of the IRA owner

If the IRA is from a deceased spouse, the IRA can be rolled over into another IRA account within 60 days. If the IRA belonged to some other person, no rollover is allowed, and any distribution will have a penalty.

Documentation required: Death certificate of the previous IRA owner.

Unreimbursed medical expenses

Documentation required: Insurance documents showing patient amounts paid during the year.

A call to active duty of a military reservist

Documentation required: Call up orders from the military.

Stay tuned for Part 6 of our “Be Prepared” series on tax preparation.

Share your comments at the bottom of the page.

© Whatismyhealth

Special thanks to our resources:

http://www.irs.gov/pub/irs-pdf/f1040.pdf

https://www.irs.gov/forms-pubs/about-schedule-b-form-1040

https://www.irs.gov/forms-pubs/about-form-1099-int

https://www.irs.gov/pub/irs-pdf/f1040s1.pdf

https://www.investopedia.com/terms/i/ira.asp

A checklist of common documents related to deductions and credits that you will need when preparing to file your taxes for last year.